By Colors Business Report

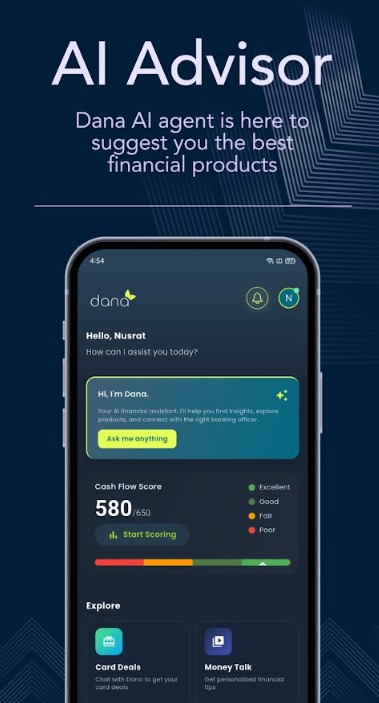

Dana AI is Bangladesh’s first AI-powered financial assistant, offering instant and intelligent financial matchmaking designed specifically for the underserved. By combining data, education, and empathy, it is reshaping how millions of people access money, creating new pathways to financial inclusion and empowerment.

A Smarter, Faster Way to Access Finance

Dana is not just a financial assistant—it’s a revolution for the credit underserved. Powered by AI and alternative data, Dana uses users’ transaction history, mobile behavior, and digital footprints to instantly connect them with personalized financial products.

Whether it’s a loan, savings account, credit card, or expert advice, Dana instantly connects users to the right products—and directly to verified bank sales officers for real-time, human guidance.

This seamless matchmaking isn’t just helpful for users—it’s a game-changer for financial institutions. Dana provides high-intent lead generation enriched with insights into user needs and affordability, turning outreach into tangible results.

Finance + Fun = Financial Literacy

Dana also makes money education simple—and even fun. Its gamified learning experience features short, engaging videos and a rewards system, helping users build financial skills while earning cashback.

Learning smart money habits becomes as engaging as earning.

This approach ensures that access to financial products is paired with confidence and capability, making Dana more than a product—it’s a financial growth partner.

A New Financial Operating System for the Next Generation

Dana is built with a vision of radical inclusivity—especially for Bangladesh’s youth and small businesses. It’s fast, fair, and flexible—meeting the needs of digital-first users who demand more from their banking experience.

“Digital banking is no longer optional—it’s essential. Today’s younger consumers expect their banking experience to feel as seamless and intuitive as Spotify or Instagram. They don’t want to depend on physical branches; they want speed, control, and convenience—something only digital-first banks can truly offer.”

Gazi Yar

“For true financial inclusion,” Zia added, “regulators must embrace a digital-first approach—supporting platforms that enable real-time payments and allowing new digital bank entrants to flourish. Just look at Southeast Asian markets like the Philippines and Indonesia—they’re advancing rapidly through digital banking. It’s time Bangladesh followed suit.”

Zia Hassan

Dana AI is more than a platform—it’s a new financial operating system for the next generation: fast, fair, and radically inclusive.

The Founders Behind the Mission

Dana was co-founded by banking veterans Gazi Yar Mohammed and Zia Hassan Siddique, who together bring 28+ years of experience in retail banking, payments, and fintech.

The two envisioned Dana as a Gen Z–focused neobank—partnering with licensed local banks to address the evolving financial needs of younger users in Bangladesh.

They also built the Dana Sales Community, where on-the-ground sales officers don’t just drive adoption—they’re mentored by senior bankers, combining business with personal growth.

From Dhaka to the UK: Scaling with Purpose

After the success of Dana, Gazi and Zia expanded globally by launching Kube Money in the UK—an AI-powered credit marketplace enabling underserved users to access:

- Smart credit scoring

- Cross-border payments

- Seamless multi-currency banking

Both founders received the UK’s Global Talent Visa in recognition of their fintech leadership. Their combined work spans:

- AI-driven credit systems

- Cross-border neobanking

- Embedded finance solutions

- Scalable digital financial products

Why Dana Matters for Bangladesh Now

We asked co-founder Gazi Yar what’s most needed for today’s youth and SMEs:

“With over 52 million people in Bangladesh between the ages of 18 to 44, this isn’t just a demographic—it’s the future of banking. If we’re not building for them, we’re already behind,” said Gazi Yar.

“Digital banking is no longer optional—it’s essential. Today’s younger consumers expect their banking experience to feel as seamless and intuitive as Spotify or Instagram. They don’t want to depend on physical branches; they want speed, control, and convenience—something only digital-first banks can truly offer.”

On the payment front, co-founder Zia Hassan highlighted an urgent need for innovation:

“Consumers are spending over ৳10,000 crore in cash annually simply because we don’t have a real-time, interoperable Account-to-Account payment platform in place,” said Zia.

And what’s the path forward?

“For true financial inclusion,” Zia added, “regulators must embrace a digital-first approach—supporting platforms that enable real-time payments and allowing new digital bank entrants to flourish. Just look at Southeast Asian markets like the Philippines and Indonesia—they’re advancing rapidly through digital banking. It’s time Bangladesh followed suit.”

Final Thought

Dana isn’t just solving for financial access—it’s reimagining what money means for an entire generation. In a world where finance should be inclusive, instant, and intuitive, Dana is leading the way for Bangladesh—and beyond.