By Naima Sultana

State-run Janata Bank PLC’s plight is a textbook case of how political influence can cripple a once-thriving financial institution in the country.

Until 2024, the bank had disbursed loans totalling Tk 1 lakh crore.

Of this, a staggering 57 percent or Tk 57,000 crore had been classified as non-performing loans by December 2024.

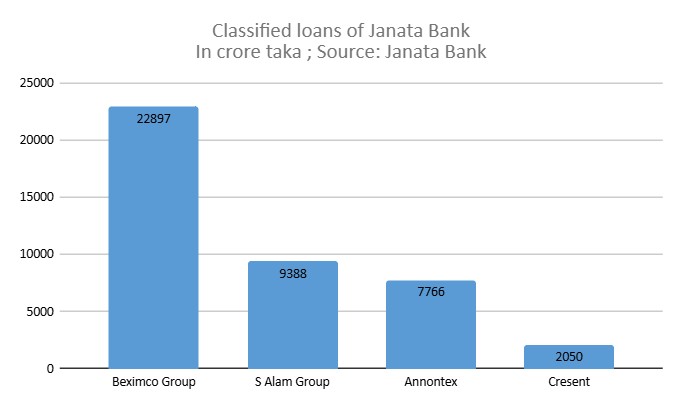

Strikingly, nearly three-quarters of these troubled loans are tied up in just four conglomerates — Beximco Limited, S Alam Group, AnonTex Group, and Crescent Group. Collectively, their defaults amount to more than Tk 42,000 crore.

The central question remains: how were these entities able to secure such vast sums from a state-owned lender?

Janata Bank’s collapse in asset quality reflects years of unchecked lending irregularities, politically-backed loan approvals, and chronic mismanagement. The situation worsened following the political changeover in August 2024, when loans previously concealed as performing — many linked to politically exposed borrowers and business houses close to the former Awami League-led administration — were reclassified as defaults.

Beximco Group, led by Salman F Rahman, former private industry and investment adviser to Sheikh Hasina, tops the defaulters’ list. The bank’s total exposure to Beximco Group stood at Tk 23,000 crore, which became fully non-performing in the October–December quarter of 2024.

By June, exposure had reached Tk 25,000 crore, roughly 950 percent of Janata Bank’s paid-up capital.

This far exceeds the regulatory single-borrower exposure limit, which prohibits banks from lending more than 25 percent of their paid-up capital to one borrower. At the time, Janata Bank’s paid-up capital was just Tk 2,400 crore.

S Alam Group follows with Tk 10,000 crore in defaults, AnonTex Group with Tk 7,800 crore, and Crescent Group with Tk 2,500 crore. Thermax Group and Sikder Group have defaulted on Tk 2,000 crore and Tk 850 crore, respectively.

Janata Bank was once considered one of Bangladesh’s most reputable lenders, consistently profitable and paying dividends to the government. Its decline began with high-profile loan scams involving AnonTex and Crescent. Between 2010 and 2015, Janata disbursed Tk 3,500 crore to 22 AnonTex companies. Bangladesh Bank later found widespread irregularities in these approvals.

In 2017, Janata Bank’s total defaults stood at Tk 5,800 crore. Just seven years later, that figure has ballooned to Tk 67,300 crore. Losses reached Tk 3,000 crore last year alone.

Bangladesh Bank data shows Janata Bank is now the country’s most distressed bank, with a capital shortfall of Tk 52,891 crore in December 2024. Its capital adequacy ratio has plunged to a shocking negative 34.6 percent, signalling severe erosion of its capital base.

Facing a deep liquidity crisis, Janata Bank has requested Tk 20,000 crore in emergency funds from the interim government and the central bank as well to maintain cash flow and restore depositor confidence.

Bank officials warn that its ability to borrow from the money market has been undermined by insufficient securities, raising fears of shortfalls in the cash reserve ratio (CRR) and statutory liquidity ratio (SLR).