At the end of 2024, low-income individuals in Bangladesh showed a steady increase in bank account deposits and numbers, signaling improved financial inclusion despite the country’s political and economic challenges. This feature explores the key developments in the banking sector, focusing on farmers, garment workers, and marginalized groups.

Growth in Low-Income Bank Deposits: A Year of Progress

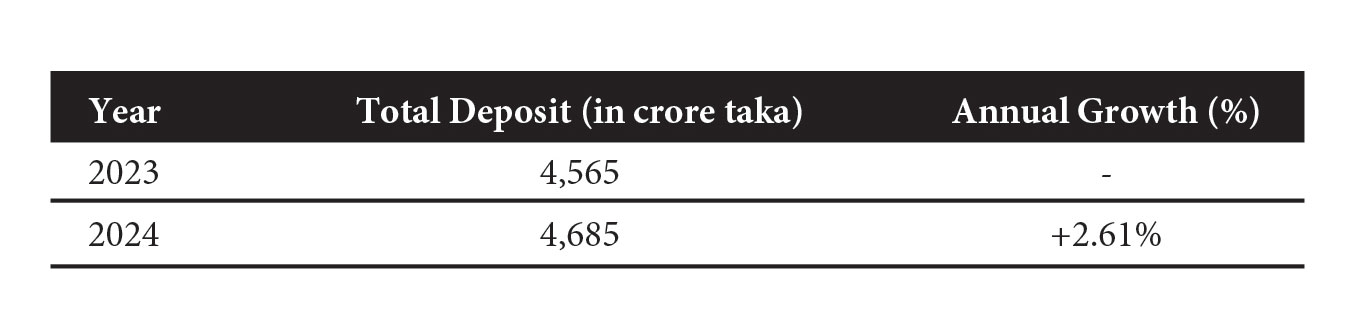

At the close of 2024, deposits in bank accounts held by low-income individuals reached a total of 4,685 crore taka—a rise from 4,565 crore taka in 2023. This marked a 120 crore taka increase or a 2.61% growth in one year.

This increase in low-income deposits demonstrates a steady, positive trend in financial inclusion for this demographic, particularly as many face the challenges of political instability and economic fluctuations.

The Surge in Bank Accounts for Farmers and Garment Workers

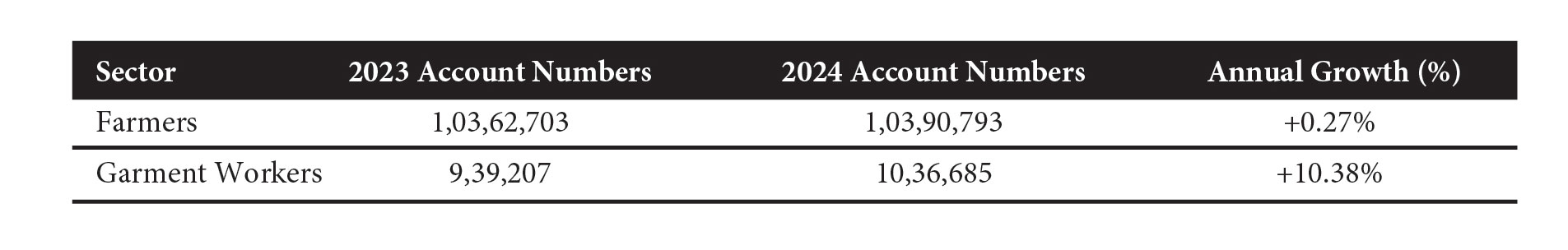

The number of bank accounts for farmers and garment workers showed impressive growth in 2024, indicating better access to banking services for these vital sectors of the economy.

l Farmers’ Bank Accounts: The number of farmers’ accounts increased by 23.35% from December 2023 to December 2024, reflecting a deepening connection to financial services.

l Garment Workers’ Bank Accounts: Similarly, the number of accounts for garment workers rose by 30.47% in the same period, indicating a significant rise in financial inclusion for this major workforce.

The Rise of No-Frill Bank Accounts

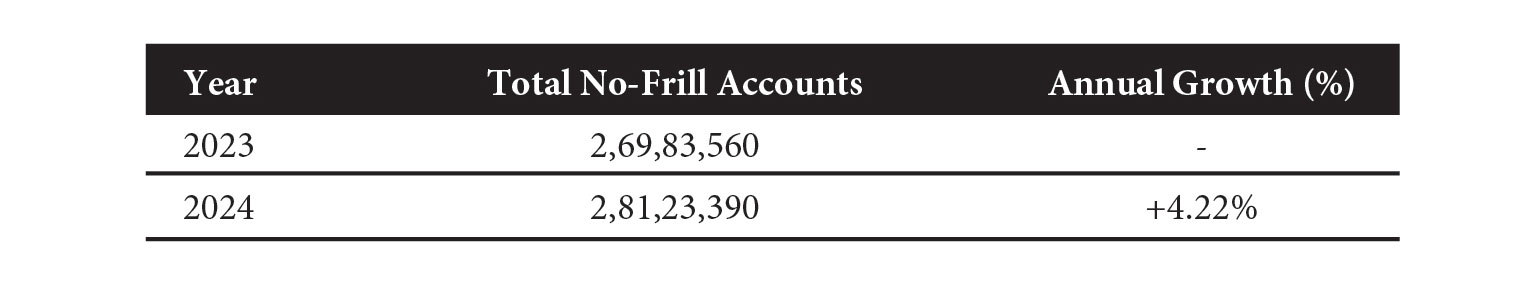

Introduced in 2010, no-frill or “no-fee” accounts have become a vital tool for increasing financial inclusion, particularly for low-income individuals. These accounts are designed with minimal conditions and no additional fees, providing a gateway to formal banking services for marginalized populations.

In 2024, the total number of no-frill accounts increased to 2 crore 81 lakh 23 thousand 390, up from 2 crore 69 lakh 83 thousand 560 in 2023, marking a 4.22% increase.

Among these, farmers’ and garment workers’ accounts made up a significant share, showing the strong demand for these accessible banking products in rural and industrial communities.

Key Banks Driving Financial Inclusion

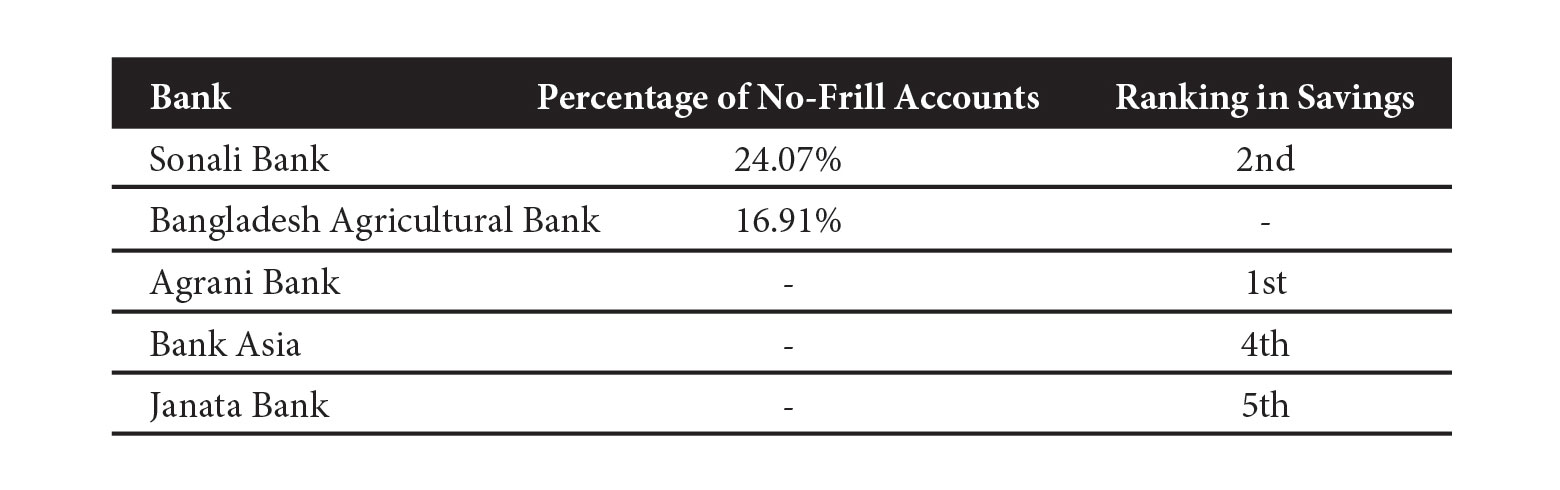

Certain banks have played a pivotal role in facilitating the opening of no-frill accounts and boosting savings for low-income groups.

- Sonali Bank has seen the highest number of no-frill accounts being opened, holding 24.07% of all such accounts.

- Agrani Bank leads in terms of total savings among these low-income accounts, followed closely by Sonali Bank and others.

Impact of Political and Economic Factors

Despite the challenges posed by political instability and changing economic conditions in Bangladesh, the banking sector has shown resilience. Although there were concerns about reduced deposits at one point due to economic instability, gradual recovery has been evident, thanks to efforts by both the interim government and Bangladesh Bank, the financial regulator.

As confidence in the banking sector increases, particularly with strategic steps to strengthen the sector’s reliability, deposits and savings have started to rebound. This signals that low-income people are increasingly turning to formal banking services for both savings and transactions, bolstering economic stability at the grassroots level.

A Positive Outlook for Financial Inclusion

The increasing number of bank accounts and deposits in Bangladesh’s low-income segments demonstrates a promising trend toward greater financial inclusion. With continuous support from government initiatives, regulatory bodies like Bangladesh Bank, and key banks, the financial landscape is gradually becoming more accessible to marginalized populations. This growth not only benefits individuals but contributes to broader economic stability and development.

As we move forward into 2025, it will be essential to continue monitoring these trends to ensure that all sectors of society, including farmers, garment workers, and the ultra-poor, have access to the financial tools they need to prosper.

Government-owned banks, particularly Sonali and Agrani, have dominated in both the number of no-frill accounts and the amount of savings held, reflecting their central role in promoting financial inclusion.